Imagine sending money across the globe and it arriving in minutes, not days, and with fees that barely make a dent in the amount you're sending. Sounds like a dream, right? Well, that dream is quickly becoming a reality, thanks to the power of blockchain technology.

Traditional cross-border payments are often riddled with inefficiencies. Think about it: navigating a complex web of intermediary banks, each taking a cut and adding processing time. Currency exchange rates can be unfavorable, and transparency is often lacking, leaving you in the dark about where your money is and when it will arrive. These hurdles can be particularly challenging for businesses, especially small and medium-sized enterprises (SMEs) operating internationally.

Blockchain technology offers a compelling solution to these challenges by providing a decentralized and transparent platform for cross-border transactions. By cutting out the need for multiple intermediaries, blockchain significantly reduces both the time and cost associated with sending money internationally. Cryptocurrencies, built on blockchain, enable near-instant transfers, and smart contracts can automate various aspects of the payment process, increasing efficiency and reducing the risk of errors.

In essence, blockchain provides faster, cheaper, and more transparent cross-border transactions. It bypasses traditional banking systems, reduces intermediary fees, accelerates processing times, and enhances security through cryptography. This revolutionizes international payments for businesses and individuals alike, fostering greater financial inclusion and global commerce. Keywords: blockchain, cross-border payments, cryptocurrency, international transactions, faster, cheaper, transparent, decentralized.

Real-World Impact: A Personal Anecdote

I remember a few years ago, I needed to send money to a family member living abroad. The process was a nightmare. I had to go to a traditional money transfer service, fill out a mountain of paperwork, and pay exorbitant fees. The money took almost a week to arrive, and I was constantly worried about whether it would reach its destination safely. This experience highlighted the clear need for a better solution. Blockchain offers just that. By leveraging a distributed ledger system, blockchain eliminates the need for intermediaries, reducing costs and processing times. Cryptocurrencies like Bitcoin and Ethereum can be used to facilitate these transactions, offering a more efficient and transparent alternative to traditional methods. Imagine a future where sending money across borders is as simple and affordable as sending an email. That's the promise of blockchain technology.

Understanding Blockchain Technology

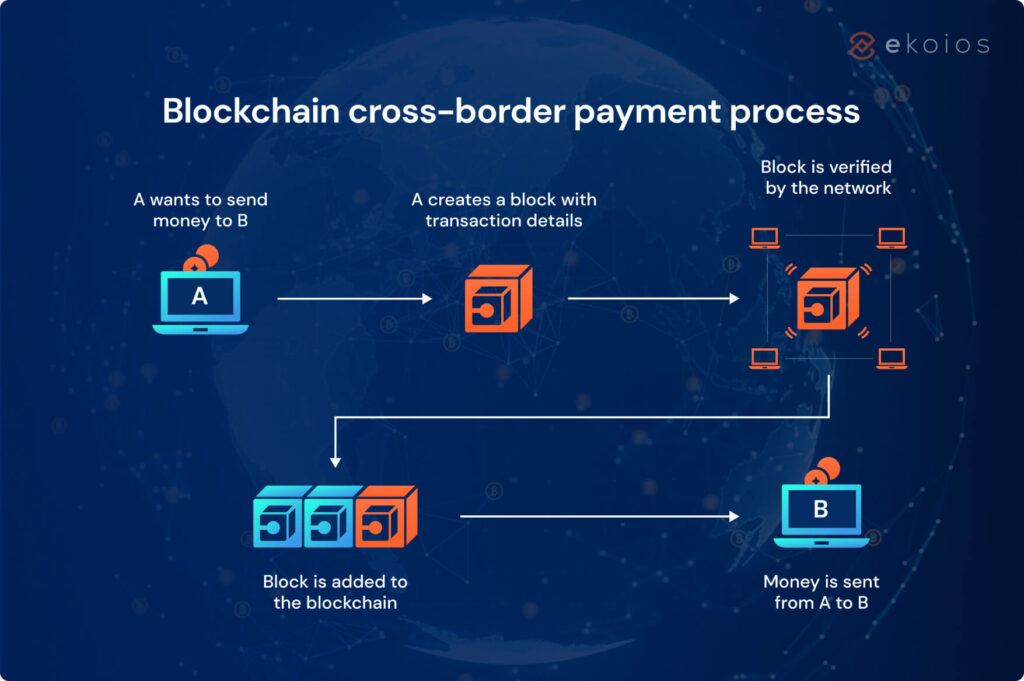

So, what exactly is blockchain, and how does it make all this possible? Simply put, a blockchain is a digital, decentralized, public ledger that records transactions across many computers. The "blocks" in the chain contain information about transactions, and each block is linked to the previous one using cryptography, making it extremely difficult to alter or tamper with the data. This inherent security and transparency are key advantages when it comes to cross-border payments. Because the ledger is distributed, no single entity controls the network, reducing the risk of censorship or fraud. Furthermore, the immutability of the blockchain ensures that transactions are recorded permanently and cannot be reversed. This provides a level of trust and security that is often lacking in traditional payment systems. The use of smart contracts, self-executing agreements written into the blockchain, can further automate and streamline the payment process, reducing the need for manual intervention and minimizing the risk of errors.

The History and Myths of Blockchain in Finance

The concept of blockchain dates back to the early 1990s, but it wasn't until the creation of Bitcoin in 2008 that it truly gained traction. Initially, blockchain was primarily associated with cryptocurrencies and often viewed with skepticism. Many dismissed it as a fad or a technology solely for illicit activities. However, as people began to understand the underlying principles and potential applications of blockchain, its reputation started to shift. The myth that blockchain is only for criminals has been largely debunked, as its transparency and security features actually make it more difficult to engage in illegal activities undetected. The history of blockchain is one of innovation and evolution, from its humble beginnings as the backbone of Bitcoin to its widespread adoption across various industries, including finance, supply chain management, and healthcare. Today, blockchain is recognized as a transformative technology with the potential to revolutionize the way we conduct business and interact with the world.

Unveiling the Hidden Secrets of Blockchain Transactions

One of the often-overlooked benefits of blockchain is its ability to provide enhanced auditability. Every transaction is recorded on the public ledger, making it easy to track the flow of funds and verify the legitimacy of payments. This can be particularly valuable for businesses that need to comply with strict regulatory requirements or conduct internal audits. Another hidden secret is the potential for blockchain to enable fractional ownership of assets. This means that multiple individuals or entities can jointly own a single asset, such as a property or a piece of art, making it more accessible to a wider range of investors. Blockchain also facilitates the creation of decentralized autonomous organizations (DAOs), which are organizations that are governed by code rather than by traditional management structures. DAOs can streamline decision-making processes and reduce the risk of corruption or mismanagement. These hidden secrets of blockchain are only beginning to be explored, and they hold the potential to unlock even greater value and innovation in the years to come.

Recommendations for Embracing Blockchain for Payments

If you're a business looking to streamline your cross-border payments, exploring blockchain-based solutions is highly recommended. Start by researching different cryptocurrency options and payment platforms that offer competitive fees and fast processing times. Consider partnering with a blockchain consultant or developer to help you integrate blockchain technology into your existing systems. Educate your employees about blockchain and its benefits to ensure a smooth transition. It's also important to stay informed about the evolving regulatory landscape surrounding blockchain and cryptocurrencies. By taking a proactive approach and embracing blockchain technology, you can gain a competitive edge and unlock new opportunities for growth in the global marketplace. Remember to prioritize security and due diligence when selecting a blockchain platform or cryptocurrency. Always conduct thorough research and seek expert advice before making any investment decisions.

The Technicalities: How Does it Actually Work?

Diving deeper into the technical aspects, the speed and cost reductions stem from several key features of blockchain. Firstly, the elimination of intermediaries, as mentioned before, cuts out the fees charged by each bank involved in a traditional wire transfer. Secondly, the use of cryptography ensures the security and integrity of transactions, reducing the need for manual verification and reconciliation. Thirdly, the distributed nature of the blockchain means that transactions can be processed 24/7, without being subject to the operating hours of traditional banks. Furthermore, the use of smart contracts can automate various aspects of the payment process, such as currency exchange and compliance checks, further streamlining the process and reducing the risk of errors. The underlying technology is complex, but the result is a far more efficient and cost-effective way to send money across borders. Consider exploring different blockchain platforms and cryptocurrencies to find the best fit for your specific needs. Some platforms are specifically designed for cross-border payments and offer features such as real-time currency conversion and multi-signature wallets for enhanced security.

Practical Tips for Using Blockchain for Transactions

When using blockchain for cross-border payments, it's crucial to prioritize security. Always use a reputable cryptocurrency wallet with strong encryption and two-factor authentication. Be wary of phishing scams and other attempts to steal your private keys. Educate yourself about the risks involved and take steps to protect your assets. Another important tip is to compare fees and exchange rates across different platforms and cryptocurrencies. Some platforms may offer lower fees but less favorable exchange rates, so it's important to do your research. Consider using a cryptocurrency exchange aggregator to compare prices across multiple exchanges. It's also advisable to start with small transactions to test the process and gain confidence. Once you're comfortable, you can gradually increase the size of your payments. Remember to keep accurate records of all your transactions for tax purposes. By following these practical tips, you can minimize the risks and maximize the benefits of using blockchain for cross-border payments.

Navigating the Regulatory Landscape

The regulatory landscape surrounding blockchain and cryptocurrencies is constantly evolving. It's crucial to stay informed about the laws and regulations in your jurisdiction and in the countries where you're sending or receiving money. Some countries have embraced blockchain and cryptocurrencies, while others have imposed strict restrictions or outright bans. Be aware of these differences and comply with all applicable laws. Consult with a legal professional to ensure that you're operating within the legal framework. It's also important to understand the tax implications of using blockchain for cross-border payments. Cryptocurrency transactions may be subject to capital gains taxes or other taxes, depending on your jurisdiction. Keep accurate records of all your transactions and consult with a tax advisor to ensure that you're complying with all applicable tax laws. The regulatory landscape is complex and ever-changing, so it's essential to stay informed and seek professional advice when needed.

Fun Facts About Blockchain and Cross-Border Payments

Did you know that the first ever Bitcoin transaction was used to buy two pizzas? This seemingly insignificant transaction marked a pivotal moment in the history of cryptocurrency and blockchain technology. Another fun fact is that some countries are exploring the possibility of creating their own central bank digital currencies (CBDCs) using blockchain technology. These CBDCs could potentially revolutionize the way we conduct financial transactions and could have a significant impact on cross-border payments. Blockchain is also being used to track the origin of goods and products, ensuring transparency and preventing counterfeiting. This is particularly valuable in industries such as food and fashion, where consumers are increasingly concerned about the provenance of the products they buy. The world of blockchain is full of surprises and exciting developments, and its potential to transform various industries is only beginning to be realized.

How to Implement Blockchain for Cross-Border Solutions

Implementing blockchain for cross-border payments requires careful planning and execution. Start by identifying your specific needs and goals. What are the pain points you're trying to address? What are the desired outcomes? Once you have a clear understanding of your objectives, you can begin to explore different blockchain platforms and cryptocurrencies that align with your requirements. Consider factors such as transaction fees, processing times, security features, and regulatory compliance. It's also important to assess the scalability of the platform to ensure that it can handle your transaction volume. Develop a detailed implementation plan that outlines the steps involved, the resources required, and the timelines. Engage with stakeholders across your organization to ensure buy-in and support. Pilot test the solution with a small group of users before rolling it out to the entire organization. Monitor the performance of the solution and make adjustments as needed. By following these steps, you can successfully implement blockchain for cross-border payments and unlock its many benefits.

What If Blockchain Transforms Cross-Border Finance Entirely?

Imagine a future where cross-border payments are instantaneous, frictionless, and virtually free. This is the potential of blockchain technology to transform the global financial landscape. In this future, businesses can seamlessly conduct international trade without being burdened by high transaction fees and lengthy processing times. Individuals can easily send money to family and friends abroad without having to pay exorbitant remittance charges. Financial inclusion is expanded to reach underserved populations who lack access to traditional banking services. The global economy becomes more interconnected and efficient, fostering greater economic growth and prosperity. This future is not just a pipe dream; it's a realistic possibility that is within our reach. By embracing blockchain technology and working together to overcome the challenges, we can create a more inclusive and efficient global financial system for all.

Listicle: Top Benefits of Using Blockchain for Transactions

Here's a quick rundown of the top benefits of using blockchain for cross-border payments:

- Reduced Transaction Fees: Eliminate intermediary fees and lower overall transaction costs.

- Faster Processing Times: Enable near-instantaneous transfers, bypassing the delays of traditional banking systems.

- Increased Transparency: Track transactions on the public ledger for enhanced accountability and security.

- Enhanced Security: Protect transactions with cryptography and prevent fraud.

- Improved Efficiency: Automate payment processes with smart contracts and streamline operations.

- Greater Financial Inclusion: Provide access to financial services for underserved populations.

- Increased Traceability: Easily track the origin and destination of funds, improving compliance.

- Reduced Risk: Mitigate the risk of errors and disputes through automated processes.

- Enhanced Scalability: Handle high transaction volumes with ease.

- Global Reach: Seamlessly conduct transactions with anyone, anywhere in the world.

Question and Answer Section

Q: How secure are blockchain-based cross-border payments?

A: Blockchain technology uses cryptography to secure transactions, making them highly resistant to fraud and hacking. However, it's important to use reputable platforms and take precautions to protect your private keys.

Q: What are the main cryptocurrencies used for cross-border payments?

A: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and stablecoins like USD Coin (USDC) are commonly used for cross-border payments.

Q: Are blockchain-based payments regulated?

A: The regulatory landscape for blockchain and cryptocurrencies is still evolving. Some countries have embraced them, while others have imposed restrictions. It's important to comply with the laws and regulations in your jurisdiction.

Q: Can small businesses benefit from using blockchain for cross-border payments?

A: Yes, small businesses can significantly benefit from lower transaction fees, faster processing times, and increased transparency offered by blockchain technology.

Conclusion of How Blockchain Enables Faster & Cheaper Cross Border Transactions

Blockchain technology is poised to revolutionize cross-border payments, offering a more efficient, cost-effective, and transparent alternative to traditional methods. By eliminating intermediaries, reducing fees, accelerating processing times, and enhancing security, blockchain empowers businesses and individuals to participate in the global economy with greater ease and confidence. While challenges remain, such as regulatory uncertainty and technological complexities, the potential benefits of blockchain for cross-border transactions are undeniable. As the technology matures and adoption increases, we can expect to see a significant shift towards blockchain-based solutions in the years to come, paving the way for a more interconnected and prosperous global financial system.